https://cannabisexaminers.com/wp-content/uploads/2020/02/2020-02-19_Santo_Domingo_Update_Figure_1_-_Quick_Payback.jpg

https://cannabisexaminers.com/wp-content/uploads/2020/02/2020-02-19_Santo_Domingo_Update_Figure_1_-_Quick_Payback.jpg

VANCOUVER, British Columbia–(BUSINESS WIRE)–Capstone Mining Corp. (“Capstone” or the “Company”) (TSX:CS) releases positive updates on its Santo Domingo copper-iron-gold project (“Santo Domingo” or the “Project”) in Region III, Chile. Updates to the Feasibility Study-level Technical Report, published on January 3, 20191 (“2019 Technical Report” or “Base Case”) includes a higher level of CAPEX/OPEX certainty, additional key permits and the development in Section 24 of a Preliminary Economic Assessment with respect to cobalt production (“2020 PEA Opportunity”). The 2020 PEA Opportunity contains pricing updates to the economic model for the Base Case and a potential investment decision for producing battery-grade cobalt sulfate. Santo Domingo is owned 70% by Capstone and 30% by Korea Resources Corporation (“KORES”).

“The 2020 PEA Opportunity for cobalt adds significantly to the already robust copper-iron-gold Base Case. We are very excited as it aligns perfectly with our vision for growth in assets that can deliver strong cash flows in all price environments,” said Darren Pylot, President and CEO of Capstone.

Opportunity to Build a Low Cost, Vertically Integrated Cobalt Business in Chile

- 2020 PEA Opportunity outlines potential for a copper-iron-gold mine with battery-grade cobalt sulfate production, resulting in a net present value at an 8% discount rate (“NPV8%“) of $1.66 billion after tax.

- Base Case copper-iron-gold project has a NPV8% of $1.03 billion.

- Incremental construction costs for a cobalt refining complex of $0.67 billion, for a combined $2.18 billion, timed to begin two years after construction begins for the copper-iron-gold plant.

- Production of an average of 10.4 million pounds of cobalt per annum in the form of 22,600 tonnes per annum (“tpa”) battery-grade cobalt sulfate, at incremental operating costs of $3.70 per pound of cobalt production costs and incremental C1 cash costs2 of -$4.11 per pound of cobalt production (including by-product sulfuric acid produced in the cobalt operation).

Mr. Pylot added, “If Santo Domingo was in operation today, refined production of 4,700 tonnes of cobalt per year would make Capstone the fourth largest battery-grade cobalt producer outside of China, and the largest in the Americas. It would also be one of the lowest cost producers in the World. It is exciting to think about what this refining complex could do to open Chile’s vast potential in cobalt. For financial flexibility, we have structured the cobalt recovery option as a delayed investment decision, timed to begin approximately two years after construction begins on the copper-iron-gold concentrator. When a strategic partner is selected, we could look to advance cobalt production earlier.”

SANTO DOMINGO HIGHLIGHTS

|

|

Base Case (no cobalt processing) |

2020 PEA Opportunity3 (incl. cobalt processing) |

|

Life of Mine (“LOM”) (years) |

18 |

18 |

|

Cobalt production period (years) |

n/a |

3-18 |

|

Initial capital cost (US$ billions) |

$1.51 |

$2.18 |

|

Net Present Value (“NPV”) (after-tax, 8% discount) (US$ billions) |

$1.03 |

$1.66 |

|

Internal Rate of Return (“IRR”) (after-tax) (%) |

21.8% |

23.0% |

|

Payback period (after-tax) (years) |

2.8 |

3.5 |

|

First Five Years of Full Production |

|

|

|

Average annual contained copper (“Cu”) production4 (million pounds) |

259 |

263 |

|

Iron concentrate (65% Fe) (“Fe”) (million tonnes) |

3.3 |

3.3 |

|

Gold (“Au”) (ounces) |

35,000 |

39,000 |

|

C1 cash costs per pound of payable copper produced (by product basis) |

$0.475 |

($0.02)6 |

|

Average Annual for LOM |

|

|

|

Copper (million pounds)7 |

137 |

140 |

|

Iron concentrate (65% Fe) (million tonnes) |

4.2 |

4.2 |

|

Gold (ounces) |

17,000 |

17,000 |

|

Cobalt (“Co”) (million pounds) |

n/a |

10.4 |

|

Sulfuric acid (million tonnes) |

n/a |

1.4 |

|

C1 cash costs per pound of payable copper produced (by product basis) |

$0.025 |

($1.56)6 |

Dr. Albert Garcia PE, Vice President of Projects commented, “Our concept for cobalt recovery in the 2020 PEA Opportunity is based on its association with pyrite which is preferentially concentrated in the flotation process at the copper cleaners/scavengers as outlined in the 2019 Technical Report, and then further upgraded to a 0.7% cobalt concentrate. The concentrate is fed through a five-stage process consisting of roasting, leaching, copper precipitation, cobalt solvent extraction, and crystallization to yield battery-grade cobalt sulfate heptahydrate. Overall, recoveries for cobalt will be approximately 78%, with additional benefits in the form of increased copper recovery, sulfuric acid production and energy generation. The flowsheet is simple and uses a series of conventional technologies that have been previously used in the mining industry.”

BASE CASE – COPPER-IRON-GOLD (“Cu-Fe-Au”) MINE (NO COBALT PROCESSING)

Santo Domingo’s Base Case economics does not include the capital to build the cobalt processing facilities nor any of the revenues from cobalt recovery. Since the completion of the 2019 Technical Report, there has been confirmation of certain capital and operating costs with the negotiation of a power purchase agreement (“PPA”), indicative offers for desalinated water purchase from third parties, firm-fixed-price (lump sum) proposal for the plant and mine facilities and firm actionable quotes for key process equipment.

- Approximate 18 year mine life with operations expected to commence two years after a final construction decision.

- Nominal average LOM plant throughput rate of 60,000 tonnes per day (“tpd”) and a maximum throughput of 65,000 tpd the first five years.

- Initial construction costs are estimated to be $1.51 billion which includes a $197 million contingency on total costs.

- On a co-product basis, total C1 cash costs8 for LOM is estimated at approximately $1.40 per pound of payable copper produced and $38.88 per tonne of magnetite iron concentrate produced.

- Sustaining capital over the LOM is estimated to be $378.6 million.

- Total LOM operating costs are estimated to be $5.57 billion.

- The LOM average production is 206,000 dry metric tonnes (“dmt”) of copper concentrate per year over a period of approximately 18 years, at a 29% copper grade. The LOM average production is 4.2 million dmt of iron concentrate per year over a period of approximately 18 years, at a 65% iron grade.

- Metal price assumptions used for the Base Case were a constant $3.00 per pound of copper, and a consensus long-term price of $69 per tonne for 62% iron fines, to arrive at an effective $80 per tonne magnetite iron concentrate at a 65% iron content FOB Santo Domingo port (which incorporates several value-in-use adjustments to reflect the specific quality of iron-ore expected to be produced by Santo Domingo), and $1,280 per ounce of gold.

2020 PEA OPPORTUNITY – PHASED COBALT PROCESSING

The 2020 PEA Opportunity considers a conceptual plan to mine and process copper, iron-ore and gold at the onset of the mine. Subsequent to the decision of building the copper-iron-gold mine, Capstone would undertake as an alternative, a follow-on phase to initiate engineering and permitting for a cobalt recovery circuit. The 2020 PEA Opportunity assumes a delay of two years for additional permitting and detailed engineering. During this development period, the cobalt laden pyrite will be stockpiled as a high-density slurry. Copper, iron and gold are mined for the 18-year mine life and processed over 18 years, and cobalt is mined for 18 years but processed over the last 16 years. The initial capital costs, NPV, IRR and payback period shown below is in consideration of the cobalt circuit as a subsequent and independent investment decision.

- Approximate 18-year mine life with operations expected to commence two years after a final construction decision. Cobalt plant construction beginning in the first year of full production (2 year period) with cobalt production from years 3 to 18.

- Nominal average LOM plant throughput rate of 60,000 tonnes per day (“tpd”) and a maximum throughput of 65,000 tpd for the first five years.

- Initial capital costs are estimated to be $2.18 billion, $1.51 billion related to the copper-iron-gold open pit mine and processing facility and $665 million related to the additional cobalt plant. This includes a contingency of $197 million on total costs for the copper-iron-gold mine and a contingency of $133 million for the cobalt opportunity, resulting in a total contingency of $330 million.

- The infrastructure design which includes a PPA and indicative price for desalinated water purchase.

- On a co-product basis, total C1 cash costs9 for LOM is estimated at approximately $1.02 per pound of payable copper equivalent (“CuEq”) produced, $27.07 per tonne of magnetite iron concentrate equivalent produced.

- Sustaining capital over the LOM is estimated to be $442.9 million.

- Total LOM operating costs are estimated to be $6.18 billion.

- The LOM average production is 209,000 dmt of copper concentrate per year over a period of approximately 18 years, at a 29% copper grade. The LOM average production is 4.1 million dmt of iron concentrate per year over a period of approximately 18 years, at a 65% iron grade.

- Commodity price assumptions used for the 2020 PEA Opportunity were a constant $3.00 per pound of copper, and a consensus long-term price of $69 per tonne for 62% iron fines, to arrive at an effective $80 per tonne magnetite iron concentrate at a 65% iron content FOB Santo Domingo port (which incorporates several value-in-use adjustments to reflect the specific quality of iron-ore expected to be produced by Santo Domingo including low alumina content), $20 per pound of cobalt, $70 per tonne CIF Mejillones for sulfuric acid and $1,280 per ounce of gold.

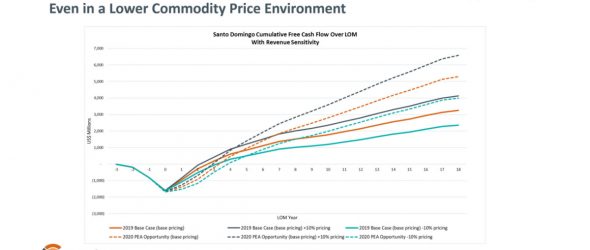

Figure 1. Santo Domingo: Quick Payback for the Copper-Iron-Gold Base Case and 2020 PEA Cobalt Opportunity, Even in a Lower Commodity Price Environment.

Refer to the Additional Price Sensitivities section below for additional price sensitivities.

After Tax Cumulative Free Cash Flow Inclusive of Capital Expenditure – Sensitivity Analysis

|

(US$ million) |

Year 5 |

Year 10 |

End of Mine Life |

|

Base Case: Cu-Fe-Au Mine |

|||

|

Base Case pricing |

$855 |

$1,774 |

$3,250 |

|

Base Case pricing +10% |

$1,210 |

$2,347 |

$4,129 |

|

Base Case pricing -10% |

$496 |

$1,197 |

$2,363 |

|

2020 PEA Opportunity: Phased Cobalt Recovery |

|||

|

PEA Opportunity pricing |

$957 |

$2,792 |

$5,293 |

|

PEA Opportunity pricing +10% |

$1,403 |

$3,587 |

$6,579 |

|

PEA Opportunity pricing -10% |

$504 |

$1,984 |

$3,988 |

Project Valuation Metrics – Price Sensitivities

|

|

NPV (after-tax, |

IRR (after-tax) |

Payback |

|

Base Case: Cu-Fe-AuMine |

|||

|

Base Case pricing |

$1.03 |

21.8% |

2.8 |

|

Base Case pricing +10% |

$1.43 |

26.4% |

2.3 |

|

Base Case pricing -10% |

$0.63 |

16.8% |

3.4 |

|

2020 PEA Opportunity: Phased Cobalt Recovery |

|

|

|

|

PEA Opportunity pricing |

$1.66 |

23.0% |

3.5 |

|

PEA Opportunity pricing +10% |

$2.21 |

27.4% |

3.1 |

|

PEA Opportunity pricing -10% |

$1.10 |

18.4% |

4.0 |

Summary of Results

|

|

Base Case |

2020 PEA Opportunity |

|

LOM (years) |

18 |

18 |

|

Cobalt production period |

n/a |

Years 3-18 |

|

Initial capital cost (US$ billions) |

$1.51 |

$2.18 |

|

NPV (after-tax, 8% discount) (US$ billions) |

$1.03 |

$1.66 |

|

IRR (after-tax) (%) |

21.8% |

23.0% |

|

Payback period (after-tax) (years) |

2.8 |

3.5 |

|

First Five Years of Full Production |

||

|

Average annual contained copper production10 (million pounds) |

259 |

263 |

|

Iron concentrate (65% Fe) (million tonnes) |

3.3 |

3.3 |

|

Average annual gold production (ounces) |

35,000 |

39,000 |

|

C1 cash costs per pound of payable copper produced |

$0.4711 |

($0.02)12 |

|

Average Annual for LOM |

||

|

Copper (million pounds)10 |

137 |

14013 |

|

Copper equivalent9,14 (million pounds) |

242 |

311 |

|

Iron concentrate (65% Fe) (million tonnes) |

4.2 |

4.2 |

|

Gold (ounces) |

17,000 |

17,000 |

|

Cobalt (million pounds) |

n/a |

10.4 |

|

Sulfuric acid (million tonnes) |

n/a |

1.4 |

|

C1 cash costs per pound of payable copper produced (by product basis) |

$0.0215 |

($1.56)16 |

|

C1 cash costs17 (co-product basis) |

|

|

|

Copper (per pound of payable copper equivalent produced) |

$1.40 |

$1.02 |

|

Magnetite iron concentrate (per tonne of iron equivalent production) |

$38.88 |

$27.07 |

|

Average annual operating expenses (US$ millions) |

$304 |

$337 |

|

Cumulative free cash flow inclusive of capital (after tax) (US$ billions) |

$3.3 |

$5.3 |

|

Life of Mine Summary |

|

|

|

Total tonnes milled (million tonnes) |

392.3 |

392.3 |

|

Strip ratio (waste to milled tonnes) |

3.3:1 |

3.3:1 |

|

Head Grade |

|

|

|

Copper (% Cu) |

0.30 |

0.30 |

|

Iron (% Fe) |

28.16 |

28.16 |

|

Gold (g/t Au) |

0.04 |

0.04 |

|

Cobalt (parts per million (“ppm”)) |

n/a |

241 |

|

Recovery |

|

|

|

Copper18 |

93.4% |

93.5% |

|

Iron mass |

19.1% |

19.1% |

|

Gold |

60.1% |

62.1% |

|

Cobalt |

n/a |

78.3% |

|

Commodity Price Assumptions |

|

|

|

Copper (per pound) |

$3.00 |

$3.00 |

|

Magnetite iron concentrate at 65% iron content CFR Santo Domingo port (per tonne) |

$80 |

$80 |

|

Cobalt (per pound) |

n/a |

$20 |

|

Gold (per ounce) |

$1,280 |

$1,280 |

|

Sulfuric Acid CIF Mejillones (per tonne) |

n/a |

$70 |

KEY DEVELOPMENTS OVER PAST YEAR

- Received all critical permits to start construction, including approval of the Mine Closure Plan.

- Negotiated Power Purchase Agreement (PPA), quotes for desalinated water supply.

- Additional metallurgical test work improving confidence in metal recoveries and confirming the process design criteria of 29% copper concentrate and 65% iron concentrate.

- Developing additional optionality for shared infrastructure development.

- Received a firm-fixed-price proposal for the EPC of the processing plant.

- Firm and actionable quotations for major processing equipment.

- Excluding port and slurry pipeline, approximately 75% of direct initial capital costs are certain.

BASE CASE and 2020 PEA OPPORTUNITY

The Base Case and the 2020 PEA Opportunity are being completed using engineering and consulting firms experienced in the Chilean mining industry (Amec Foster Wheeler Ingeniería y Construcción Limitada, a Wood company, Blue Coast Metallurgy Ltd., BRASS Chile S.A., Knight Piesold S.A., NCL Ingeniería y Construcción Ltda., Aminpro Chile, Sunrise Americas and Roscoe Postle Associates Inc.), with the authors named below in “Qualified Persons”. The report is being compiled by the Wood Group’s Santiago office.

The Base Case and the 2020 PEA Opportunity includes development of two open pit mines using conventional drilling, blasting, loading with diesel hydraulic shovels, and truck haulage, and a copper-iron concentrator designed to process a maximum 65,000 tpd to a nominal capacity of 60,000 tpd (throughput is reduced in the latter years as the ore becomes slightly harder) using Semi-Autogenous Grinding (“SAG”) and ball milling, with conventional flotation utilizing desalinated water to produce a copper concentrate. Magnetite iron will be recovered from the copper rougher tailings using Low Intensity Magnetic Separation. The planned infrastructure in both the Base Case and 2020 PEA Opportunity include a tailings storage facility (“TSF”); an iron concentrate pipeline and a third party desalinated water supply pipeline; a port-located magnetite iron concentrate filter plant and stockpile; a port-located copper concentrate storage building; a desalination plant; ship loading facilities; and on-site and off-site infrastructure and support facilities.

The mine is located 50 kilometres southwest of Codelco’s El Salvador copper mine and 130 kilometres north-northeast of Copiapó, near the town of Diego de Almagro, in Region III, Chile. The elevation at the site is approximately 1,000 metres above sea level (“masl”) with relatively gentle topographic relief. Access to the property is one kilometre off the paved highway C-17 from Diego de Almagro to Copiapó. The magnetite filter plant and stockpile, the copper storage building, the desalination plant and other port infrastructure will be located in Punta Roca Blanca, 41 kilometres north of Caldera. The name of the proposed port development is Puerto Santo Domingo.

For the first five years of full operation, Santo Domingo will have an annual average copper production of approximately 259 million pounds (approximately 117,500 tonnes). The LOM average production is 137 million pounds of copper (approximately 61,000 tonnes) per year over a period of approximately 18 years. The total LOM copper production is estimated at 2.4 billion pounds (approximately 1.1 million tonnes).

For the first five years of full operation, the annual average iron-ore concentrate production is estimated to be 3.3 million dmt. Over the LOM, the iron-ore concentrate production will increase to an annual average of 4.2 million dmt, with a total estimated production of approximately 75.1 million dmt.

MINERAL RESOURCE ESTIMATE

Following is the current Mineral Resource Estimate as at February 13, 2020 prepared by David W. Rennie, P. Eng., of Roscoe Postle Associates Inc. (“RPA”).

|

Mineral Resource Estimate as at February 13, 2020 |

||||||||

|

Category |

Deposit |

Mt |

CuEq (%) |

Cu (%) |

Au (g/t) |

Fe (%) |

S (%) |

Co (ppm) |

|

Measured |

66 |

0.81 |

0.61 |

0.081 |

30.9 |

2.3 |

254 |

|

|

Indicated |

SDS/IN |

416 |

0.49 |

0.24 |

0.033 |

26.4 |

2.2 |

239 |

|

Estrellita |

55 |

0.40 |

0.38 |

0.039 |

13.7 |

0.0 |

125 |

|

|

Sub-Total |

471 |

0.48 |

0.26 |

0.034 |

25.0 |

1.9 |

225 |

|

|

Total Measured and Indicated |

537 |

0.52 |

0.30 |

0.039 |

25.7 |

2.0 |

229 |

|

|

Inferred |

SDS/IN |

42 |

0.42 |

0.18 |

0.024 |

25.0 |

2.4 |

208 |

|

Estrellita |

5 |

0.32 |

0.31 |

0.030 |

12.3 |

0.0 |

108 |

|

|

Total Inferred |

48 |

0.41 |

0.19 |

0.025 |

23.6 |

2.2 |

197 |

|

Mineral Resource Estimate Notes:

- Mineral Resources are classified according to CIM (2014) definition standards.

- Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- The Qualified Person for the estimates is Mr. David Rennie, P. Eng., an associate of Roscoe Postle Associates Inc.

- Mineral Resources for the Santo Domingo Sur, Iris, Iris Norte, and Estrellita deposits have an effective date of 13 February 2020.

- Mineral Resources for the Santo Domingo Sur, Iris, Iris Norte, and Estrellita deposits are reported using a cut-off grade of 0.125% CuEq. CuEq grades are calculated using average long-term prices of US$3.50/lb Cu, US$1,300/oz Au, and US$99/dmt Fe conc.

- Only copper, gold, and iron were recognized in the CuEq calculation.

- Mineral Resources are constrained by preliminary pit shells derived using a Lerchs–Grossmann algorithm and the following assumptions: pit slopes averaging 45º; mining cost of US$1.90/t, processing cost of US$7.27/t (including G&A cost); processing recovery of 89% copper and 79% gold; and metal prices of US$3.50/lb Cu, US$1,300/oz Au and US$99/dmt iron concentrate.

- Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content.

- Tonnage measurements are in metric units. Copper (“Cu”), iron (“Fe”) and sulfur (“S”) are reported as percentages, gold (“Au”) as grams per tonne and cobalt (“Co”) parts per million.

The estimate was carried out using a block model constrained by three-dimensional wireframe envelopes. The wireframes were constructed primarily from lithological boundaries. The principal rock types used for these models were the manto-hosting volcanic and sedimentary units which were clipped against fault boundaries and wireframe models of post-mineral dykes or sills. Eight domains were created within the deposit and three of these (Zones 1, 2 and 3) were further subdivided into magnetite-rich and magnetite-poor variants. Much of the geological interpretation had been done for the 2009 and previous estimates. For the current estimate the wireframe modelling consisted of updating the earlier work with the latest drilling results. RPA notes that only minor modifications to the interpretations were required.

Grades for copper, gold, total iron and magnetic susceptibility (“MS”) were estimated into the blocks using Ordinary Kriging (“OK”). Estimates of recoverable iron (“Fe_rec”) and bulk density were carried out from the estimated iron and MS grades using linear regression relationships. CuEq grades were calculated from the estimated copper, gold, and Fe_rec, using recoveries estimated from recent metallurgical testing.

The Mineral Resources for SDS/IN were reported at a cut-off grade of 0.125% CuEq, which is consistent with the previous estimate.

Readers are advised that Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Mineral Resource estimates do not account for mineability, selectivity, mining loss and dilution. These Mineral Resource estimates include inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Even though test mining has been undertaken in areas with Measured and Indicated class Mineral Resources, there is no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves, once economic considerations are applied.

BASE CASE MINERAL RESERVE ESTIMATE

The current Mineral Reserve estimate of November 14, 2018, prepared by Carlos Guzmán, (FAusIMM of NCL Ingeniería y Construcción Ltda.) for the Base Case, remains current and is summarized below. Based on the Mineral Resource estimate, a standard methodology for pit limit analysis, mining sequence, and cut-off grade optimization, including application of mining dilution, process recovery, economic criteria and physical mine and plant operating constraints, has been followed to design the open pit mines and determine the Mineral Reserve estimate for each deposit. The Mineral Reserves are summarized in the following table.

|

Mineral Reserve Estimate as at November 14, 2018 |

|||||||

|

Reserve Category |

Ore Grade |

Contained Metal |

|||||

|

Ore |

Cu |

Fe |

Au |

Cu |

Fe Conc. |

Au |

|

|

Proven Reserves |

65.4 |

0.61 |

30.9 |

0.08 |

878.5 |

8.2 |

169.9 |

|

Probable Reserves |

326.9 |

0.24 |

27.6 |

0.03 |

1,694.2 |

66.9 |

336.8 |

|

Total Reserves |

392.3 |

0.30 |

28.2 |

0.04 |

2,572.7 |

75.1 |

506.7 |

Mineral Reserve Estimate Notes:

- Mineral Reserves have an effective date of 14 November 2018 and were prepared by Mr. Carlos Guzman, CMC, an employee of NCL.

- Mineral Reserves are reported as constrained within Measured and Indicated pit designs and are supported by a mine plan featuring variable throughput rates and cut-off optimization. The pit designs and mine plan were optimized using the following economic and technical parameters: metal prices of US$3.00/lb Cu, US$1,290/oz Au, and US$100/dmt of Fe concentrate; average recovery to concentrate is 93.4% for Cu and 60.1% for Au, with magnetite concentrate recovery varying on a block-by-block basis; copper concentrate treatment charges of US$80/dmt, U$0.08/lb of copper refining charges, US$5.0/oz of gold refining charges, US$33/wet metric tonnes (“wmt”) and US$20/wmt for shipping copper and iron concentrates respectively; waste mining cost of $1.75/t, mining cost of US$1.75/t ore, and process and G&A costs of US$7.53/t processed; average pit slope angles that range from 37.6º to 43.6º; a 2% royalty rate assumption, and an assumption of 100% mining recovery.

- Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content.

- Tonnage measurements are in metric units. Copper and iron grades are reported as percentages, gold as grams per tonne. Contained gold ounces are reported as troy ounces, contained copper as million pounds and contained iron as million metric tonnes.

BASE CASE MINE PRODUCTION SCHEDULE

The cash flow model is supported by a mine plan developed to an annual level of detail, which is available in the Santo Domingo section of our website at www.capstonemining.com. Approximately 45 million tonnes of material would be pre-stripped in the year prior to start-up of operations and used in the construction of the TSF starter dam, handling material only once. The overall strip ratio for the LOM is 3.3:1. The plan developed for the 2019 Technical Report mines higher copper grades in the first five years of the mine life with progressively lower copper grades and higher iron grades for the remaining 13 years.

BASE CASE and 2020 PEA OPPORTUNITY PROCESS DESCRIPTION

The copper and magnetite recovery plant and associated service facilities will process run of mine (“ROM”) ore delivered to a primary crusher feeding a conventional process of crushing and grinding of the ROM ore, copper flotation, and magnetite recovery from copper rougher tailings. Copper concentrate will be produced and dewatered at the process facility for trucking to (and stockpiling at) the port. Magnetite concentrate will be thickened on site prior to being pumped via a concentrate pipeline to the port. At the port, the magnetite concentrate will be dewatered and stockpiled. Both the copper and magnetite concentrates will be loaded onto ships for transportation to third-party smelters.

Iron recovery was determined from magnetic separation testing on the copper flotation rougher tailings. The Base Case does not consider any process to recover the specular hematite portion of the iron. Therefore, iron recovery is presented in terms of the total mill feed mass recovery. For the life of the mine, this averages 19.1%, and ranges from a low of 10.1% in year five of the Project to a high in excess of 25% in the last four years of the mine life. Testing via pilot plant indicates that a magnetite concentrate grading 65% to 67% iron can be maintained throughout the life of the mine.

For the cobalt opportunity, cobalt was estimated for the Mineral Resources and the existing mine plan. The cobalt flowsheet would begin with the tails from the copper cleaner/scavenger, where cobalt is naturally concentrated, to about 0.24% Co and further enriched in a pyrite flotation to about 0.7% Co. It is then processed via a roast, leach, purification, solvent extraction and crystallization.

A detailed Mine Production Summary and Plant Feed Production Schedule showing tonnes processed, grades and recoveries is available in the Santo Domingo section of our website at www.capstonemining.com.

The tailings storage system will consist of a TSF located east of the proposed mine. The TSF is designed to store approximately 314 million tonnes of conventional thickened tailings, which is sufficient capacity for the approximately 18 years of the mine life. Storage of both desalinated and process water is proposed in lined ponds near the plant site. Water make-up is proposed to be desalinated water. Based on the conventional thickened tailings disposal method, the estimated water make-up will be approximately 1,260 m3/h (~350 L/s).

BASE CASE OFFSITE INFRASTRUCTURE AND SERVICES

The Level 3 Capital construction estimate for this Technical Report included 100% of the capital requirements of a greenfield port in the Punta Roca Blanca area (Puerto Santo Domingo) on the coast 41 kilometres north of Caldera in the Atacama Region (Region III). Included in the cost estimates is the terminal station of the concentrate pipeline, storage tanks and filter plant for magnetite concentrate, a copper concentrate storage building, a magnetite concentrate stockpile, integrated building (offices, laboratories, change house and lunch room), guard checkpoint, workshop and warehouse; and ancillary facilities to support the operation. The port facility is designed to accommodate the maximum throughout requirements of 5.4 million tpa.

Access to the mine site is six kilometres south of Diego de Almagro on Highway C-17. This section is paved and in good condition. Due to the location of the planned Iris Norte pit, process facility and tailings storage facility, approximately 18.7 kilometres of the existing C-17 road will require relocation. The existing C-17 road will remain in service during the relocation effort. In addition, a new bypass road will be built around Diego de Almagro to minimize traffic impacts from the Project. The Diego de Almagro bypass is approximately 4.7 kilometres in length and will be built in the early stage of the Project.

BASE CASE WATER AND CONCENTRATE TRANSPORT

Santo Domingo Project uses desalinated water which will be pumped to the mine/process site. Capstone has received indicative proposals for the supply of desalinated water from third-party local suppliers with proven record of delivery. Desalinated water was adopted due to several compelling considerations, including confirmed gold and copper recoveries, and lower desalination costs due to lower electricity prices secured through a PPA.

A magnetite concentrate pipeline will transport magnetite concentrate from the process plant to the filter plant at the port via a pipeline starting at an elevation of 1,027 masl and ending at the port at an elevation of 16 masl. The copper concentrate will be trucked from the site to Puerto Santo Domingo.

Both the water and the concentrate pipelines will use the same right-of-way and will run parallel to existing roads for the majority of the distance from the mine area to the port. The pipeline route will largely follow the valleys with the single route high point located approximately 45 kilometres from the mine site near Mantos Copper’s Mantoverde mine operation.

BASE CASE POWER

Santo Domingo’s mine and port sites will be connected to the national grid system at local substations near the facilities. The necessary mine-area connection permit has been approved. The 2019 Technical Report assumed a price of $72 per MWh, including all system-related charges, for electricity delivered to the nearest electrical substations to the mine site and the port site. In 2019, a request for proposal for a PPA was advertised, adjudicated and awarded. The estimated of this price is based on: negotiated (energy) price plus estimated system charges, resulting in $66 per MWh, which is lower than the value in the economic model. This PPA did not require a “Take of Pay” clause nor a parent guarantee and is subject to Capstone issuing a Full Notice to Proceed for construction. The estimated peak demand for the mine and port is 112 MW.

BASE CASE INITIAL CAPITAL COST ESTIMATE

The initial capital costs for the Base Case (Cu-Fe-Au Mine) has been confirmed and estimated at $1.51 billion as shown in the following table. This estimate is based upon a constant foreign exchange rate of 600 Chilean Pesos (“CLP”) to US$1.00 during the development period and for the LOM.

|

Base Case: Cu-Fe-Au Mine INITIAL CAPITAL COST ESTIMATE |

(US$ millions) |

|

Mine Equipment |

106.77 |

|

Mine Pre-Production Stripping |

57.12 |

|

Crushing |

43.40 |

|

Grinding |

114.96 |

|

Flotation |

57.97 |

|

Magnetic Separation |

40.08 |

|

Thickening and Tailings Handling |

52.98 |

|

Reagents |

9.39 |

|

Copper Concentrate |

12.02 |

|

Tailings Storage Facility |

23.66 |

|

Plant/Mine Infrastructure |

156.72 |

|

Magnetite Concentrate Pipeline |

89.09 |

|

Port – Process |

25.73 |

|

Port – Concentrate Handling/Loading |

121.64 |

|

Port – Infrastructure |

21.89 |

|

Total Direct Cost |

933.40 |

|

Development – Indirects (includes EP and CM costs) |

156.84 |

|

Construction Admin Costs |

112.37 |

|

Owner Costs |

111.83 |

|

Contingency (15% of total costs) |

197.85 |

|

Total Indirect Costs |

578.88 |

|

TOTAL INITIAL CAPITAL COSTS |

1,512.28 |

Mine pre-production stripping costs are estimated at $57.1 million and are included in the initial capital cost estimate. LOM sustaining capital, estimated at $378.6 million over the approximately 18 year mine life, is not included in the above figure. Mine closure costs have been estimated at $102 million and have been included in the financial model. In 2019, the Closure Plan was formally approved by the Chilean authorities. The updated closure cost has been used for the PEA assessment as $110.4 million.

2020 PEA OPPORTUNITY INITIAL CAPITAL COST ESTIMATE

The initial capital costs for the additional cobalt circuit has been estimated at $665 million as shown in the following table. This estimate is based upon a constant foreign exchange rate of 600 CLP to US$1.00 during the development period and for the LOM.

|

2020 PEA Opportunity INITIAL CAPITAL COST ESTIMATE |

(US$ millions) |

|

Civil & Earthworks |

39.57 |

|

Mechanical, Supply & Install |

186.21 |

|

Structural |

34.92 |

|

Platework |

25.60 |

|

Piping |

23.28 |

|

Electrical & Instrumentation |

38.79 |

|

Buildings |

53.30 |

|

Total Direct Cost |

401.67 |

|

Indirect Costs |

130.62 |

|

Contingency (25% of total costs) |

133.07 |

|

Total Indirect Costs |

263.69 |

|

TOTAL INITIAL CAPITAL COSTS |

665.35 |

The updated closure cost has been used for the PEA assessment as $110.4 million.

SUMMARY OF OPERATING COST ESTIMATE3

Base Case: Cu-Fe-Au Mine

As shown, the estimate total C1 cash costs19 over LOM are estimated at $0.02 per pound of payable copper produced, when including gold and iron credits. The co-product LOM C1 cash costs20 are estimated at approximately $1.40 per pound of payable copper and $38.88 per tonne of magnetite concentrate produced.

|

BASE CASE: Cu-Fe-Au Mine Total Project Operating Costs21 |

|||

|

LOM Total |

LOM Average |

LOM C1 Cash Costs22 |

|

|

Mining |

2,619.57 |

6.68 |

1.13 |

|

Process |

2,547.56 |

6.49 |

1.10 |

|

G&A |

402.84 |

1.03 |

0.17 |

|

Sub-Total |

5,569.97 |

14.20 |

2.40 |

|

By-Product Credits |

|

|

(2.70) |

|

Treatment and Refining Charges and Selling Costs |

|

|

0.31 |

|

TOTAL C1 cash costs23 per pound of payable copper produced |

|

|

0.02 |

PERMITTING

In July 2015, Capstone received approval of the Environmental Impact Assessment (“EIA”) for the mine as described in the Base Case. The EIA will require minor modifications as a result of improvements assessed in the 2020 PEA Opportunity. The Maritime Concession was approved in March 2016.

In July 2017, long lead-time permit applications required to start construction were submitted, and they have all since been received, including formal approval of the Mine Closure Plan received in 2019. The permits received include Mine Development, Plant, Tailings Storage Facility, Waste Rock Storage, Flora and Fauna Rescue, Change of Land-Use and High Voltage Connection.

IRON-ORE PRICING

The 2020 PEA Opportunity uses a constant metal price assumption of $80 per tonne of magnetite iron concentrate. This assumption reflects a long-term benchmark price of 62% iron of $69 per tonne. Included in the evaluation are premiums for 65% iron magnetite product and low alumina content. Based on a long-term analysis of trans-oceanic chartering costs, a shipping cost of $20 dmt was assumed over the life of the mine. The $80 per tonne figure is expressed FOB Santo Domingo port. The $80 per tonne figure is expressed FOB Santo Domingo port.

ADDITIONAL COMMODITY PRICE SENSITIVITIES

Figure 2: Santo Domingo: Cumulative Free Cash Flow Sensitivities, Commodity Prices +/- 30% for the Copper-Iron-Gold Base Case and 2020 PEA Cobalt Opportunity.

NATIONAL INSTRUMENT 43-101

A National Instrument 43-101 (“NI 43-101”) Technical Report will be prepared to summarize the results of the Base Case by the Qualified Persons and will be filed on SEDAR within 45 days of this news release and will include a 2020 PEA Opportunity study of an alternative development option that summarizes the Cu-Fe-Au circuit at a conceptual level and adds a cobalt recovery circuit, based on Measured and Indicated Mineral Resources only.

Readers are cautioned that the conclusions, projections and estimates set out in this news release are subject to important qualifications, assumptions and exclusions, all of which will be detailed in the 2020 technical report. To fully understand the summary information set out above, the 2020 technical report that will be filed on SEDAR at www.sedar.com should be read in its entirety.

QUALIFIED PERSONS

The following Qualified Persons (“QPs”), as defined by NI 43-101 are independent from Capstone (except as noted below) and have reviewed and approved the content of this news release that is based on content from their respective portions of the 2020 technical report:

- Joyce Maycock, P. Eng., Amec Foster Wheeler Ingeniería y Construcción Limitada, a Wood company

- Antonio Luraschi, CMC, Amec Foster Wheeler Ingeniería y Construcción Limitada, a Wood company

- Marcial Mendoza, CMC, Amec Foster Wheeler Ingeniería y Construcción Limitada, a Wood company

- Mario Bianchin, P. Geo., Amec Foster Wheeler Ingeniería y Construcción Limitada, a Wood company

- Roy G. Betinol, P. Eng., BRASS Chile S.A

- Carlos Guzmán, CMC, FAusIMM, NCL Ingeniería y Construcción Ltda

- Roger Amelunxen, APEG, Aminpro Chile

- Tom Kerr, P. Eng., Knight Piésold S. A.

- David Rennie, P. Eng., Roscoe Postle Associates Inc.

- Michael Gingles, MMSA, Sunrise Americas

- Gregg Bush, P. Eng. (Non-Independent)

- Lyn Jones, P. Eng., MPlan International

ABOUT CAPSTONE MINING CORP.

Capstone Mining Corp. is a Canadian base metals mining company, focused on copper. Our two producing mines are the Pinto Valley copper mine located in Arizona, USA and the Cozamin copper-silver mine in Zacatecas State, Mexico. In addition, Capstone has the large scale 70% owned copper-iron Santo Domingo development project in Region III, Chile, in partnership with Korea Resources Corporation, as well as a portfolio of exploration properties. Capstone’s strategy is to focus on the optimization of operations and assets in politically stable, mining-friendly regions, centred in the Americas. We are committed to the responsible development of our assets and the environments in which we operate. Our headquarters are in Vancouver, Canada and we are listed on the Toronto Stock Exchange (TSX). Further information is available at www.capstonemining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This document may contain “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). These forward-looking statements are made as of the date of this document and Capstone Mining Corp. (the “Company”) does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation.

Forward-looking statements relate to future events or future performance and reflect Company management’s expectations or beliefs regarding future events and include, but are not limited to, statements with respect to the estimation of mineral reserves and mineral resources, the conversion of mineral resources to mineral reserves, the ability to successfully complete the strategic review process, the ability to further enhance the value of the project, the expected timing for commencement of construction of the Santo Domingo project, the market for project debt, Capstone’s ability to raise its equity contribution to the project, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital and construction expenditures, success of mining operations, environmental risks, the timing of the receipt of permits, the timing and terms of a power purchase agreement, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “outlook”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. In this document certain forward-looking statements are identified by words including “explore”, “potential”, “will”, “scheduled”, “plan”, “planned”, “estimates”, “estimated”, “estimate”, “projections”, “projected”, “await receipt” and “expected”. Forward-looking statements are based on a number of assumptions which may prove incorrect, including, but not limited to, the development potential of the Santo Domingo project and current and future commodity prices and exchange rates. By their very nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, changes in project parameters as plans continue to be refined; future prices of commodities; possible variations in mineral resources and reserves, grade or recovery rates; accidents; dependence on key personnel; labour pool constraints; labour disputes; availability of infrastructure required for the development of mining projects; delays in obtaining governmental approvals, financing or in the completion of development or construction activities; objections by the communities or environmental lobby of the Santo Domingo mine and associated infrastructure and other risks of the mining industry as well as those factors detailed from time to time in the Company’s interim and annual financial statements and management’s discussion and analysis of those statements, all of which are filed and available for review on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking statements.

ALTERNATIVE PERFORMANCE MEASURES

“C1 Cash Costs” and “Total Project Operating Cost” are Alternative Performance Measures. These performance measures are included because these statistics are key performance measures that management uses to monitor performance. Management uses these statistics to assess how the Company is performing to plan and to assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a meaning within International Financial Reporting Standards (“IFRS”) and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

This news release contains disclosure that has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of U.S. securities laws. Without limiting the foregoing, this news release refers to a technical report that uses the terms “measured”, “indicated” and “inferred” mineral resources. U.S. investors are cautioned that, while such terms are recognized and required by Canadian securities laws, the SEC under Industry Guide 7 does not recognize them. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. U.S. investors should also understand that “inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of “inferred resources” will ever be upgraded to a higher category. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred resources exist, or that they can be mined legally or economically. Accordingly, information concerning descriptions of mineralization and resources contained in this news release may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements under Industry Guide 7 of the SEC.

1 See Capstone News Release dated November 26, 2018 titled “Capstone Mining Releases Positive Technical Report and Launches a Strategic Process for Santo Domingo” and the Technical Report published January 3, 2019 for full details.

2 These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

3 Increase from Base Case numbers due to updated metal algorithms and not related to the cobalt opportunity. No Inferred Mineral Resources are included in 2020 PEA Opportunity. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

4 Contained production includes recovery loss.

5 C1 cash costs are net of magnetite iron and gold by-product credits and selling costs. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

6 C1 cash costs are net of magnetite iron, cobalt, sulfuric acid, and gold by-product credits and selling costs. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

7 After recovery loss.

8 These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

9 These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release. C1 cash costs per pound of copper on a co-product basis includes the value of iron and cobalt production as copper equivalent production using relative values based on pricing used the 2020 PEA Opportunity. C1 cash costs per tonne of iron on a co-product basis includes the value of copper and cobalt production as iron equivalent production using relative values based on pricing used in the 2020 PEA Opportunity.

10 After recovery loss.

11 C1 cash costs are net of magnetite iron and gold by-product credits and selling costs. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

12 C1 cash costs are net of magnetite iron, cobalt, sulfuric acid, and gold by-product credits and selling costs. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

13 Integrated copper production considering contribution of concentrator plant plus the copper recovery from the cobalt circuit as precipitate.

14 Includes the conversion of magnetite iron (and cobalt for the 2020 PEA case) production into copper equivalent units based on relative values using technical report pricing assumptions.

15 C1 cash costs are net of magnetite iron and gold by-product credits and selling costs. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

16 C1 cash costs are net of magnetite iron, cobalt, sulfuric acid, and gold by-product credits and selling costs. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

17 Includes gold (and sulfuric acid for the 2020 PEA Opportunity case) as by product credits. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

18 Copper recovery is for the copper concentrator only.

19 C1 cash costs are net of magnetite iron and gold by-product credits and selling costs. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

20 These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

21 These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

22 These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.

23 C1 cash costs are net of magnetite iron and gold by-product credits and selling costs. These are alternative performance measures; please see “Alternative Performance Measures” at the end of this news release.