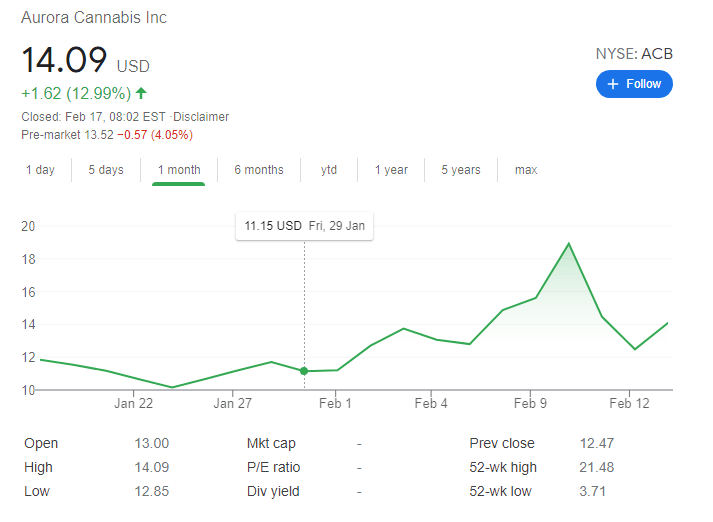

- NYSE: ACB has jumped by nearly 13% on Tuesday after as the roller coaster continues.

- A Canadian pension fund nearly quintupled its holdings of Aurora Cannabis Inc.

- After the stock split, the next moves depend on US politics and pot sector consolidation.

Cannabis consumption is for the young, eh? In Canada, buying shares of Aurora Cannabis Inc is also for the old – and that is driving shares of the weed company higher. According to a filing with the US Securities and Exchange Commission (SEC), pension fund British Columbia Investment Management (BCI) has roughly quintupled its holdings in Aurora to 290,404.

The boost that the Edmonton-based company received from the west has sent share prices to $14.09 – but that only reverses part of the previous fall for teh volatile weed stock.

ACB stock split

ACB was one of the leading companies when Canada legalized marijuana in October 2018 but has its financial woes forced it to enact a reverse stock split at a ratio of 1 to 12 back in May 2020. Nine months on from the move that saved Aurora from becoming a penny stock and risking delisting, the company is in better shape.

Apart from the move from BIC, another gray-haired related figure may also boost its shares – US President Joe Biden. While Canadian firms are making inroads into various states, the lack of a nationwide policy – either legalization or decriminalization – undermines the sector. The black market is still active and competition is cut-throat.

Biden’s Democrats are now laser-focused on passing the $1.9 trillion covid relief package. The sooner that happens – and it may come as early as February 26 – the faster marijuana makes it to the agenda. Senate Majority Leader Chuck Schumer is among those pushing for laxer rules for the industry.

Another source of optimism for Miguel Martin’s company comes from the Merger and Acquisition (M&A) activity in the pot sector. Hexo,(NYSE: Hexo), a Canadian rival of Aurora, is expanding its business after buying Zenabis Global. Will a larger firm buy ACB? There are no related developments, but that cannot be ruled out.

ACB stock predictions

For those following shares of NYSE: ACB and the pot sector in general, one thing is guaranteed – high volatility. The first upside target is the round $15 level, followed by $18.92, which was the peak close in February. Support awaits at $12, followed by the round $10 level.

More: Sundial has three reasons to rise

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.