Devastated bars and lounges in addition to the nation’s hard-hit hashish sector may have entry to $40 billion in new credit score being made accessible through the federal government’s enterprise financial institution throughout the COVID-19 disaster, its CEO stated on Sunday.

In an interview with The Canadian Press, Michael Denham stated this system from the Enterprise Growth Financial institution of Canada would now be open to all companies.

“Any authorized enterprise is eligible to be a part of this system — that was what I believe some trade teams had been involved about,” Denham stated from Montreal. “That was clarified and we’re going to formally announce it on Monday.”

Candidates should undergo their very own banks to entry this system.

The enterprise improvement financial institution is a federal company with a mortgage portfolio of about $35 billion. The $40-billion credit score availability program will probably be along with that, Denham stated.

Though it backstops greater danger loans than banks do, the Crown company does purpose to be commercially viable. These approaching their monetary establishments for entry to this system must present they might have been in a position to deal with a mortgage earlier than the coronavirus hit.

[ Sign up for our Health IQ newsletter for the latest coronavirus updates ]

The event financial institution, which has about 60,000 purchasers, has been making different modifications given the unprecedented impression of the pandemic, Denham stated. It has lowered its rates of interest, waived charges, and elevated the quantity of danger it’s taking up with its loans.

“All these modifications are supposed to make ourselves as simple and accessible inside the confines of BDC being a lender,” Denham stated. “We’re doing what we have to do.”

Struggling companies have been urgent for deferment of current mortgage obligations in addition to entry to capital loans to assist them climate the COVID storm.

The restaurant sector has been significantly onerous hit by widespread closures governments and well being authorities have ordered in an effort to curb the unfold of COVID-19. A current survey instructed virtually one in 10 eating places had already closed, and almost one in 5 anticipated to shut if situations didn’t enhance rapidly.

The hashish trade, which had been struggling pre-pandemic, has additionally had shops shut, though on-line gross sales proceed.

READ MORE:

Dwell updates: Coronavirus in Canada

The event financial institution has seen a flood of recent candidates in current weeks. As many functions have are available through its on-line financing platform for the reason that begin of the disaster in mid-March as would usually be obtained in a full 12 months.

“That’s indicative of the quantity of demand and quantity we have to have to cope with,” Denham stated. “We’re organizing ourselves to have the ability to cope with that degree of quantity, due to the depth of the disaster.”

Like many different Canadians, the event financial institution’s 2,300 workers had been despatched residence on Friday, March 13. The group reopened for enterprise on the next Monday, with workers working remotely.

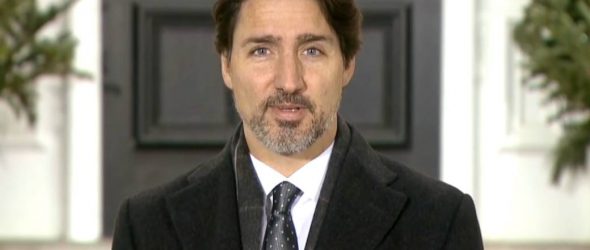

In the meantime, functions for federal authorities aid advantages are anticipated to begin flooding in Monday as individuals who have misplaced their jobs start making use of for emergency pay. Prime Minister Justin Trudeau stated individuals would begin getting their $2,000 a month inside 5 days in the event that they used direct deposit.

“My recommendation to all entrepreneurs: Perceive the packages, discuss to your financial institution, see what’s best for you, and take benefit,” Denham stated.

© 2020 The Canadian Press