A middling day for cannabis stocks ended with a whimper as the North American Marijuana Index fell 0.94 points to 109.10 on Monday. Investors on both sides of the border were left holding the bag to start the week as the United States and Candian Marijuana Indices both fell, 0.45 and 0.59, respectively. The US Index ended the day at 50.97, while the Canadian Index closed out Monday at 202.46.

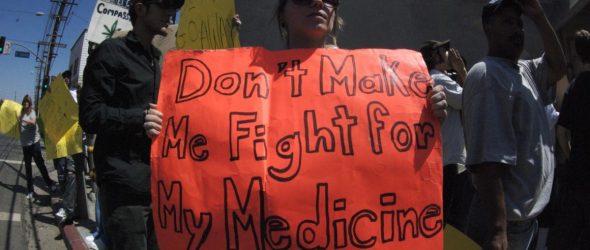

Meanwhile, investors and the larger cannabis community were still reeling Monday morning from the Drug Enforcement Agency’s not-so-subtle efforts to overstep their bounds in regards to US hemp laws. The world’s premier group of narcs issued an interim rule on hemp, hemp-derived CBD, and other hemp-derived cannabinoids last week in a way that’s inconsistent with the 2018 Farm Bill.

Simply put, the 2018 bill legalized hemp with a THC concentration below 0.3 percent. It also legalized hemp derivatives — concentrates, oils, etc. But, according to the DEA’s recent ruling, that could be a problem.

As the DEA wrote last week”

“[The 2018 Farm Bill limits] the definition of marihuana to only include cannabis or cannabis-derived material that contain more than 0.3% delta-9-tetrahydrocannabinol (also known as Δ9-THC) on a dry weight basis. Thus, to fall within the current CSA definition of marihuana, cannabis and cannabis-derived material must both fall within the pre-[2018 Farm Bill] CSA definition of marihuana and contain more than 0.3 percent Δ9-THC on a dry weight basis. Pursuant to the [2018 Farm Bill], unless specifically controlled elsewhere under the CSA, any material previously controlled under Controlled Substance Code Number 7360 (marihuana) or under Controlled Substance Code Number 7350 (marihuana extract), that contains 0.3% or less of Δ9-THC on a dry weight basis—i.e., “hemp” as that term defined under the [2018 Farm Bill]—is not controlled. Conversely, any such material that contains greater than 0.3% of Δ9-THC on a dry weight basis remains controlled in schedule I.”

Basically, the extraction process sometimes results in products with THC levels above the legal limit, even though they are not for public consumption and are diluted by the manufacturer. The DEA has taken a bad-faith reading of the Farm Bill and deemed these products illegal, putting the entire CBD industry in jeopardy.

Furthermore, because the DEA wasn’t done having fun apparently, one of the products they’ve taken it upon themselves to deem illegal is Delta-8 THC, a psychotropic byproduct of hemp that is legal under the Farm bill and does not fall anywhere under the analog act. Many companies have already taken their products off the shelves, although some have decided to take a stand and are suing the DEA.

Cannabis stock winners and losers

Cansortium Inc (CNTMF) gained $0.0274 per share up to $0.3475, an increase of 8.56 percent. Las Vegas’ Planet 13 Holdings Inc. (PLNHF) increased $0.245 to $3.555, a gain of 7.40 percent. Curaleaf Holdings Inc. (CURLF) rose $0.47 per share up to $8.36 for an increase of 5.96 percent.

GrowGeneration Corp. (GRWG) fell $3.005 per share down to $14.34 for a loss of 17.32 percent. Sundial Growers Inc. (SNDL) fell $0.0454 down to $0.3439, a decline of 11.66 percent. Finally, Indus Holdings Inc. (INDXF) fell $0.1202 per share down to $1.3198 for a loss of 8.35 percent.

Curaleaf opens in the Sunshine State

Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) opened its 29th retail location in Florida on Monday, proving that a down economy is still good business for the cannabis industry. Then location will carry both Curaleaf and Select brand products, which includes first-to-market Curaleaf sublingual tablets.

“Curaleaf remains committed to the Florida market and its patients by providing high-quality medical cannabis products and new consumption formats that make cannabis accessible for all,” said Joe Bayern, President at Curaleaf in a statement. “We are thrilled to open Clearwater and support the health and wellness needs of more Floridians.”

In other cannabis news…

Over the past year, cannabis sales in British Columbia rose from $4.2 million to $29.4 million year-over-year. Canada saw sales jump $91.7 million to $201 million over the same period.

And yet, illegal cannabis still outsells the legal stuff up North. According to a recent report in Bloomberg, “cannabis is now a C$2.2 billion ($1.7 billion) retail industry, yet legal consumption is still just 46% of the total, according to data from Statistics Canada.”

Still, a new report predicts big things for Canada’s cannabis market. According to Forbes, “Amidst the COVID-19 pandemic, a new report expects Canada’s recreational marijuana industry to double revenues this year and grow more than 500% by 2025. This should be good news for cannabis ETFs, many of which are far off their highs.”